The prices of commodities and their impact on the state of financial regulation are proof enough of the increasing interconnectivity in the world. As per Kavan Choksi Professional Investor, gaining a good understanding of how the global economy and related trends can impact their investments can help an investor to prepare accordingly and ensure financial security. Even though the global economy might seem abstract, at its core it does involve interconnected economic activities between multiple nations.

Kavan Choksi Professional Investor briefly talks about the impact of the global economy on investments

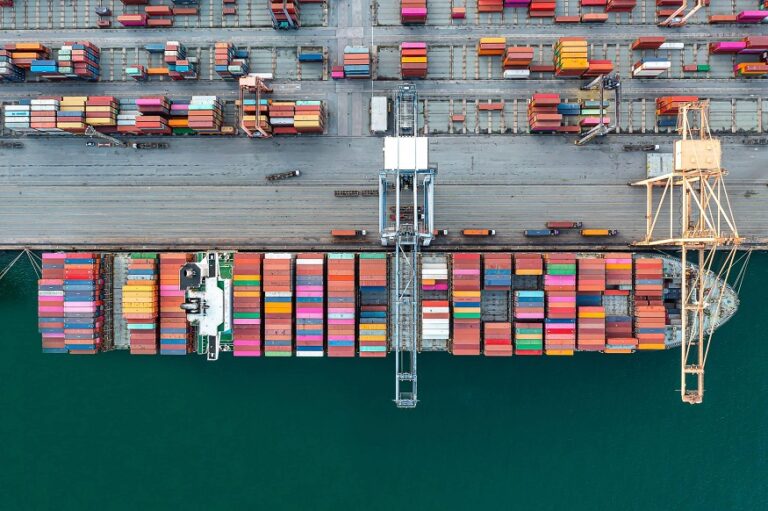

International transactions between major economies in the world majorly drive the global economy. Such exchanges tend to encourage market competitiveness in varied countries, and promote innovation of products that they have cornered the international market on. International transactions also help in empowering underdeveloped nations and allow them to import and export their goods more freely. As nations are quite interconnected in a global economy, it is next to impossible to find one that is not impacted by what is happening in another country at any point in time. The production and exchange of goods and services at such a scale may potentially disrupt the stability of a nation that imposes too many restrictions on such exports and imports.

Increased investment is easier with the presence of the global economy, which attracts more short-and long-term investments that go a long way in improving developing markets. Diverse factors can impact how well the global economy performs, which ultimately influences the personal finances of a person. Investors take on the risk of being affected by international markets whenever they invest. However, there are a few specific ways their personal finances are implicated.

Geopolitical conflicts may impact different sectors on an international scale. For instance, the war in Ukraine triggered a supply shock on agricultural produce, and drove up the prices of important commodities like fertilizer and wheat. The price of metals also sharply went up, particularly the ones used in industries like transport, engineering and construction. Owing to such increases, supply chains risked getting further clogged up. Investment prices increased across all commodities, including gold. However, gold does prove to be a good investment in almost any situation as it provides better long-term returns than most other commodities.

Kavan Choksi Professional Investor mentions that globalization especially increases accessibility for the investors and provides them with investment opportunities across countries, along with connections in various financial markets. Business today often increases their international investments out of mutual interest, as well as the need to stay internationally competitive. Hence, continues to encourage more capital inflow into the country. The developments in international trade and investment are also reflected in the changes driving the financial services industry. This industry is now largely geared towards technological advancement, wider inclusion, and building de-centralized financial systems.

Owing to the interconnected nature of the global economy, it is affected by decisions made by domestic financial institutions, which play out as controls on interest rates. Interest rates are used by central banks to manage price rises and inflation. Increased interest rates can increase the cost of borrowing and mortgage interest repayments, thereby providing consumers more incentive to save rather than spend their disposable income. Higher interest rates can also discourage firms and consumers from making risky investments.

+ There are no comments

Add yours